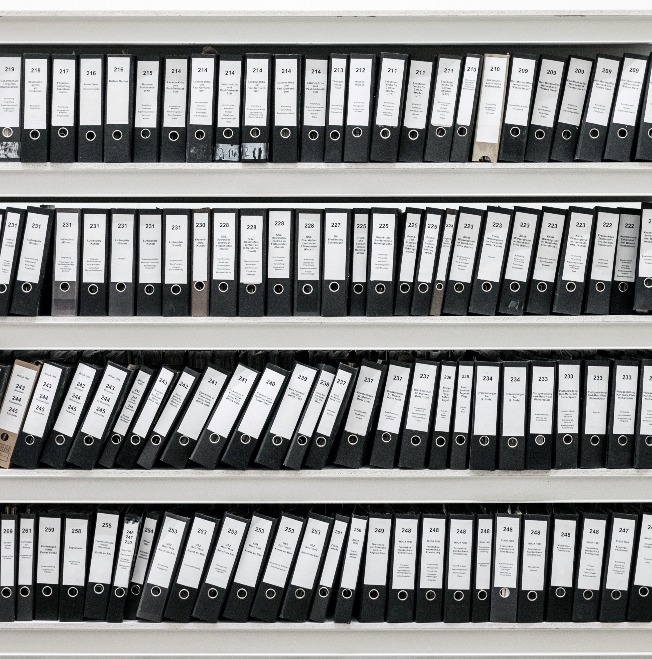

Keeping complete records of your investments, from the beginning to the end of ownership, is simply good business. A major reason for maintaining accurate records is to calculate your gains or losses when you do sell the property. If you do not have all the documentation to back up your claims to the IRS, and you do have an audit, you could have serious tax consequences. In addition, you could need records during the holding period of your investment to defend a lawsuit or tax return. Keep copies of the records supplied to you by your accountant, property manager, insurance agent, attorney, or anyone else connected to the purchase, operation, or sale of your investment. Organize all your documents in a secure place at your residence or business. Always prepare for the unexpected such as a disaster, fire, flood, etc., that could destroy your investment records. Store backup copies in a safe deposit box, at another location, or scan and upload to an Internet storage site. Do not depend on others to keep track of your documentation. They could be the ones who have the unfortunate disaster, preventing them from supplying duplicate records to you. Service businesses, such as our property management company, accumulate vast amounts of records over the years, and legislation often regulates the length of time required to keep records. When the requisite time passes, companies shred and dispose of records to make room for new ones, or to avoid storage costs – another reason to keep important documents you receive. There are three phases of investment records to keep:

- Acquisition

- Operating Life

- Sale

Acquisition

When you buy a property, you receive a lot of documentation showing the purchase amount, terms of sale, recording dates, expenses, inspection records, etc. You will need the purchase documentation when you sell the property. It may be that you acquired the property through an inheritance or gift. It is equally important to track down all the information that could affect your tax liability when the property sells. If you do not know what you need, consult a tax attorney or accountant to accumulate or establish the appropriate records.

Operating Life

While you have the investment, expenses are a key factor for determining tax returns, and will definitely have an impact on future capital gains or losses. Income, repairs, major improvements, insurance, property taxes, management fees – keep anything that affects your tax return, liability, and eventually, profit and loss. Store records accurately and properly to retrieve them easily when necessary. You could need them while you own the property for an insurance claim, audit, tenant lawsuit, etc.

Sale Documentation

Selling, just like buying, generates a mountain of paperwork and the same advice applies – keep all records of the sale – recording, inspections, expenses, etc. Store this information with the purchase and operating expenses so that you have a complete investment file. Do not view organizing accurate records of your investment as an irritation or a chore. Instead, take the positive approach that you are protecting your investment.

If you have a question about this topic or need assistance with anything else, contact a TierOne Real Estate Property Manager at 801-486-6200 - we're here to help you with your rental/investment property whether you're a current client, or one in the making.